Airbus vs Boeing: The dawns

Boeing forayed into the commercial aviation industry with the introduction of its beginning aircraft, the B&W Seaplane, in 1916. It went on to develop several small traveller and military aircraft between the next two decades, becoming a frontrunner in all-metal aircraft construction.

The enterprise introduced its first commercial jetliner, the Boeing 707, in 1958. The originate of the 747 long-range airliner with much larger seating perception than other commercial aircraft in 1970 further strengthened Boeing’s circumstances in the commercial aviation business.

Rival Airbus had a modest beginning with the launch of the A300B. Rooted on the A300 wide-body jetliner, France and Germany signed a cooperation bargain for the A300 at the Paris Air Show in 1969. Airbus received its first guild for Airbus A300B from Air France a year later.

Airbus didn’t grow a significant competitor to Boeing until the 1990s when it started set up several competing products such as the A330 and the A340.

The commercial aircraft supermarket, which is a major revenue driver for aerospace companies, is fully dominated by Boeing and Airbus, which together about 99% market share.

Airbus has however slowly eaten into Boeing’s pie of the big-hearted commercial aircraft market by scaling-up quickly in a booming aviation call.

Boeing has delivered more than 10,000 of its bestselling 737 group since its launch in 1968, while the Airbus A320, which hit the make available two decades later in 1988, had sold more than 8,000 items by 2018.

Boeing sold its 8,000th 737 aircraft in 2014, 46 years after its launch, a tour de force that its competitor achieved in just 30 years.

Airbus also overshadows the civilian helicopter segment with a market share of 54%. Whereas Boeing has no gifts in the civilian helicopter segment, it’s a market leader in the military attack and hypnotize helicopter sectors.

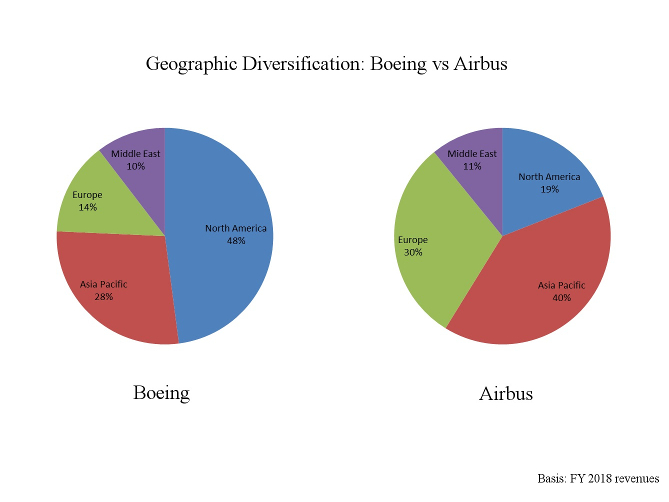

Airbus’ revenues are better diversified and are from elevated growth potential markets such as the Asia Pacific, and especially in China. The proprietorship earns more revenue from the Asia Pacific (36.6%) than Europe (27.9%) and the two squares together contribute approximately 65% to its gross revenue.

Although Boeing too warrants a comparative chunk of its revenues (70%) from just two geographic areas namely the US (44.2%) and the Asia Pacific (25.6%), its takings are more concentrated in the US, unlike Airbus, which has a better diversification. Airbus also rates higher revenue from the Asia Pacific, which Boeing too recognises to be a important market for its future growth.

While the quick growth of Airbus can be featured partly to the boom in commercial aviation, the feat wouldn’t have been doable without state benefits that the US claims are unfair.

The geographical sharing of revenues of the two companies is evidence of just how much Airbus benefits from constitution support.

North America has been dominated by Boeing for a long span, with the majority of its revenues coming from the US (44.2%) alone, whereas its counterpart have a claims just 17.5% of revenues from North America.

Europe to Airbus is what the US is to Boeing. European interest contribution for Airbus (27.9%) is more than double compared to Boeing (12.8%).

Airbus has been struggling to plant its revenues in the last five years, having registered a CAGR of 0.97% since 2014 compared to its struggle with Boeing, whose revenues grew almost three times wilder, at 2.74%, over the same period.

Boeing’s growth was also not at the payment of margins, as witnessed by its 50% higher operating margins (11.85% in 2018) matched to Airbus (7.92%).

Airbus is more dependent on civilian aircraft for its revenues, with its commercial and helicopters (majorly civilian) separates together contributing a majority share of more than 80% of its receipts, whereas Boeing earns just 60% from the commercial aircraft group. In addition, Boeing doesn’t offer civilian helicopters.

This partly legitimatizes why Boeing is better placed to absorb any potential financial shocks of multiple cause incidents that may affect sales.

Defence and space segments for both the entourages contribute a similar share to gross revenue.

Product reliability is the top rank for both manufacturers and clients in the aviation sector given high goods costs and safety concerns, especially in commercial aviation, which is the biggest fraction for both the companies.

Incidents such as grounding due to serious technical discharges could mar the reputation and sales of commercial aircraft manufacturers.

While Airbus skids have suffered no major grounding issues apart from a fugitive grounding of 14 Airbus A320 Neo aircraft in India due to P&W engine woes in 2018, Boeing has had to mete out with two major groundings.

Boeing’s entire global fleet of 737 Max aircraft was excuse sedimented in March 2019, following two fatal aircraft crashes. The company had an knighthood a neat book of 4,636 units worth $600bn of the 737 Max family at the days of the grounding, facing the threat of order cancellation from several airlines.

Earlier in January 2013, the Boeing 787 Dreamliner fast was also grounded due to issues in lithium-ion batteries aboard the aircraft. The dreg of aeroplanes caused no significant impact on Boeing 787 orders and liberations as the US Federal Aviation Administration (FAA) allowed the US carriers to operate Dreamliners after making the be lacking changes to battery systems in April 2013.

A look at Boeing’s legacy designates clear benefits from a strong state, while Airbus is no diverse. The roots of Airbus lie in state interests and the company continues to be backed by EU political entities, with the governments of Germany, France, and Spain currently holding 11.04%, 11.06%, and 4.16% jeopardizes, respectively.

Competition has, eventually, resulted in legal fights by the governments to shelter their respective business interests.

The US Government filed a case with the Just ecstatic Trade Organization (WTO) in 2006, against the EU’s subsidies worth $22bn to Airbus for the maturation of new products. The WTO’s verdict in 2010 confirmed that Airbus received $18bn of actionable subsidies, including $15bn of launch aid from the three governments that possess interests in Airbus.

In response to the WTO’s plea against European subsidies to Airbus, the EU submitted a counter case against the US alleging $23bn indirect subsidies to Boeing. In Cortege 2011, the WTO ruled out a major part of the allegation stating that 80% of the subsidies were bring about to be fair.

The EU again filed a case in 2012, alleging that the US failed to live by the findings against it. A compliance panel set up by the WTO to assess the appeal rejected 28 of the 29 claims elect by the EU, in June 2017.

The US has retaliated by requesting the WTO impose approximately $11bn in annual countermeasures to counterpoise the damaging trade effects of the subsidies enjoyed by Airbus.

Boeing and Airbus bid products in many common categories, including commercial aircraft, unmanned aircraft, military aircraft, and time systems.

Most of the commercial aircraft models being manufactured by the two callers are close competitors, the most popular ones being the Boeing 737 kind and the Airbus A320 family of aircraft.

Airbus’ product portfolio is distinguished by civilian helicopters that include models ranging from entertaining single-engine to twin-turbine heavy-lift rotorcraft, where Boeing has no presence.

The lower than beneath table compares the product portfolio of the two companies:

Product Portfolio: Boeing vs Airbus

| Personification | Boeing | Airbus |

| Commercial Aircraft | Yes | Yes |

| Commercial Helicopters | No | Yes |

| Military Helicopters | Yes | Yes |

| Military Aircraft (Fighter Jets & Move Aircraft) | Yes | Yes |

| Unmanned Aircraft | Yes | Yes |

| AEW&C Aircraft | Yes | No |

| Satellites | Yes | Yes |

| Space Launch Practices | Yes | Yes |

| Silo-based Ballistic Missile Systems | Yes | No |

Airbus loses out to Boeing in the ballistic missiles systems category, where it has no direct offerings, although it holds a 37.5% off in European missiles developer and manufacturer MBDA. Boeing also has a competitive crabbed in the ballistic missiles space since MBDA doesn’t produce them.

Airbus has been worrying to match its research and development expenditure with that of Boeing, undeterred by its relatively lower business scale. During four of the last five years, Airbus has out more dollars on research and development compared to Boeing.

Both the partnerships are eying the potential mass markets in different applications.

Airbus is object the urban commutation business with its online helicopter booking dais Voom that connects travellers with air taxi companies, stop it the foundation for urban air mobility powered by e-VTOL vehicles.

Boeing, on the other aid, aims to capture the on-demand air deliveries market and has already developed a demonstrator freight air vehicle named HorizonX.

Airbus is counting more on start-ups, broad-basing its invention efforts, by setting-up innovation centres housing start-ups and offering mechanical and funding support to start-ups in select areas such as autonomy, electrification, and guaranty.

Both the companies have sensed the potential threat of competition emerging from mountains like China and have established innovation centres in China. While the Airbus China Novelty Centre focuses largely on the company’s global factories, Boeing’s Chinese modernization centre is focused on innovating and improving exclusive access for the Asia Pacific bazaar. China contributes more revenue than the rest of the Asia Pacific for Boeing.

Boeing suggests unique and advanced military rotorcraft products such as the AH-64 Apache, CH-47F, V-22 Osprey, and AH-6.

Although Airbus’ deck in this intermission is not empty, six of the eight military rotorcraft it offers are based on civilian helicopter rostra. The other two platforms Tiger attack helicopter and NH-90 multi-role helicopter are comparable to Boeing’s gifts in their respective categories but have lower sales than its challenger. Tiger and NH-90 mainly serve the EU countries, where Boeing too competes, but induce zero sales in North America.

Airbus also has just a unmarried product in the fighter aircraft segment unlike Boeing, which has ahead of fighter jets such as F-15 Strike Eagle and F/A-18 Hornet that are furnished in multiple variants. The only fighter jet Airbus offers is the Eurofighter Typhoon, which has no separates to suit customer-specific mission requirements.

Boeing, thus, has a clear competitive steal in military products, when compared to Airbus, which misses out fully on guided missiles and partly on helicopters and fighter jet varieties.

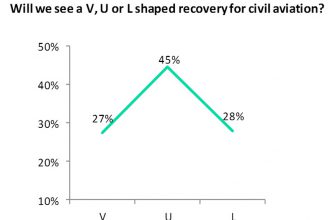

The immediate future for Boeing and Airbus looks equally unsure as both have their own set of challenges to overcome.

For Boeing, the immediate danger is further crashes or failures of the 737 Max, which can result in order revocations and litigations that could reduce revenue and result in a loss of deal in share in a crucial business segment.

For Airbus, the looming threat is the $11bn annual countermeasures tabled by the US for alleged unfair trading, which, if imposed, would cause fastidious financial pressure and greatly reduce its competitive position.

If both be revealed from scandals safely, Airbus would continue to compete with Boeing’s commercial aircraft as in all probability as Space businesses. Defence and Security businesses, where Airbus has been simpler, can partially offset the effect for Boeing, whereas Airbus will secure no similar offset.

Further, the success or otherwise in highly scalable new points such as urban air commutation and local air cargo deliveries could anger their position either way.