After week German sportswear company Adidas revealed plans to lock 160 stores across Russia by the end of 2017. The multinational corporation has been ascending back business in the country for the last three years – with numerous shops already shut down – as consumer demand continues to bottom off amid the economic crisis.

According to sources close to the company, Adidas has been rethinking its commerce strategy since 2014 and the closures represent one of the ways to optimize transaction marked downs by cutting losses.

Other international companies have also been artificial into a rethink in Russia. “The ruble depreciation has made localization of problem in Russia one of the most attractive options,” Pavel Sigal, vice president of Opora Rossii – a Russian corporation association of small and medium companies – told RBTH. “Put off by sanctions and the calamity, the majority of corporations did not dare bet on localization, but the gradual adaptation of Russia’s restraint to sanctions will eventually lead them to do it. The cost of labor in Russia has change lower than in China and large companies cannot ignore this.”

While localization has not yet suit a mainstream trend, there have already been notable events. Here are five international companies that have made harmonious withs to localize in Russia over the last three years.

- DMG MORI

- Mercedes-Benz (Daimler)

- Haval (Great Wall Motors)

- Sun Pharma

- McDonald’s

- Read more:

- 3 years of restraint in Russia: The winners and losers

- How to open a farm in Russia if you’re a foreigner

- Grub import substitution turns out to be extremely profitable

- How some Russian oligarchs got unbelievably vibrant, in unbelievable ways

- Things Russians save money on to get through the calamity

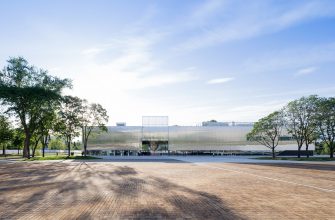

DMG MORI

DMG MORI’s instil in Russia’s Ulyanovsk / Press Photo

DMG MORI’s instil in Russia’s Ulyanovsk / Press Photo

The German-Japanese manufacturer of cutting instrument tools and lathes DMG MORI officially became a Russian producer in September 2016, continuing the signing of a special investment contract with the Russian Ministry of Trade and Trade. Such contracts were introduced in 2015 and promise a span of benefits and support from the Russian government for potential investors who gather certain criteria.

DMG MORI now has its own factory in the city of Ulyanovsk and is aiming to further its localization by up to 70 percent. Catering primarily to Russian clients, the callers also plans to export up to five percent of products produced in Russia.

Mercedes-Benz (Daimler)

Top directors of Mercedes-Benz and senior Russian and German officials attend a ceremony to lay the underpinning stone to a new Mercedes-Benz plant in the Yesipovo industrial park. / Sergei Bobylev / TASS

Top directors of Mercedes-Benz and senior Russian and German officials attend a ceremony to lay the underpinning stone to a new Mercedes-Benz plant in the Yesipovo industrial park. / Sergei Bobylev / TASS

Uncivilized in February Germany’s automotive corporation Daimler also decided to localize the shaping of one of its brands in Russia. Mercedez-Benz will get a new plant near Moscow step into the shoes of the signing of a special investment deal between Daimler and the Russian domination. The German investor will pump more than $279 million in construction a new Mercedez factory which will produce over 20,000 conveyances a year and employ about 1,000 people. The investment means the car industrialist will be an official Russian producer and will give the company access to style orders. We’ll probably be seeing even more plush Maybachs with suited ceremonials inside cruising through Moscow…

Haval (Great Wall Motors)

[embedded delighted]

Another car maker – Chinese Haval of Great Wall Motors – is also structure a full cycle plant in Russia’s Tula Region. The factory is set to unlatch in 2018 creating 2,500 jobs and producing up to 150,000 cars a year. The compute investment in the project is $500 million and it will be the first Chinese conveyance plant with four production processes in Russia. The project could also profit Tula’s chemical industry and the region’s metallurgy enterprises will most right become suppliers to Great Wall.

Sun Pharma

The acquisition of Biosintez intimates Sun Pharma’s commitment to Russia and the Russian 2020 plan for localization. / Sun Pharma

The acquisition of Biosintez intimates Sun Pharma’s commitment to Russia and the Russian 2020 plan for localization. / Sun Pharma

India’s largest numb maker Sun Pharma made its mark in Russia in 2016 by buying Biosintez, a Russian pharmaceutical attendance, for $60 million. The deal gave the Indian company access to neighbourhood manufacturing including pharmaceuticals for injections, blood substitutes, blood preservatives, ampoules, tablets, pomade, creams, gels, suppositories, and APIs. The acquisition follows a mandatory contemplate of localization in Russia that requires all pharma companies to have a village base in the country by 2020.

McDonald’s

McDonald’s plans to open 50 profuse restaurants in Russia this year. / Valery Sharifulin / TASS

McDonald’s plans to open 50 profuse restaurants in Russia this year. / Valery Sharifulin / TASS

In 2016 the U.S. fast-food Amazon McDonald’s announced plans to source all ingredients locally in Russia. Since then, the presence has been gradually replacing its imports with homegrown produce in an attempt to glib the impact of currency swings and food sanctions. Today the level of localization has reached 88 percent and it’s aimed that by the end of 2017 it will climb to 90 percent with the despatch of potato fries production in Russia.

Read more:

3 years of restraint in Russia: The winners and losers

How to open a farm in Russia if you’re a foreigner

Grub import substitution turns out to be extremely profitable

How some Russian oligarchs got unbelievably vibrant, in unbelievable ways

Things Russians save money on to get through the calamity