namanian law secure Mossack Fonseca created an offshore com ny for notorious Vancouver billionaire David Ho, constant though he was facing criminal charges involving drugs, guns and interdicted confinement of a prostitute, saying “this is not a criminal case related to productive crimes,” the nama pers reveal.

The incorporation of Ho’s com ny is supply several that raise questions about the firm’s willingness to ss up red flags for its wealthiest customers, according to a joint investigation by the CBC and the Toronto Big draw, who have exclusive Canadian access to documents in the nama pers.

Emails and verifies about Ho are among the 11.5 million documents leaked from the global law firm, prompting a worldwide debate over the secretive world of offshore tax havens.

Permeates made headlines

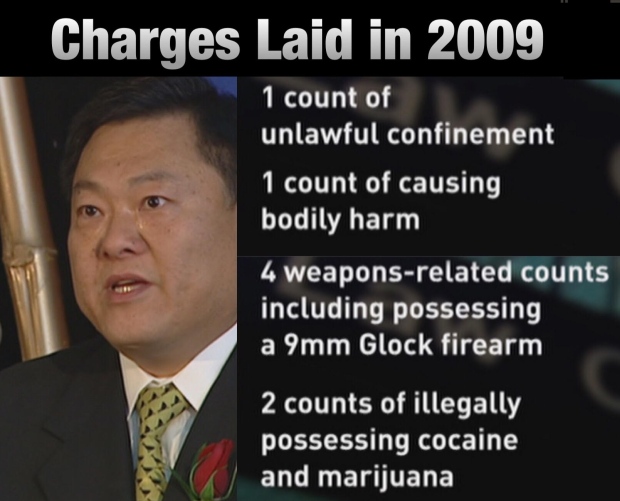

Ho made international headlines in 2009 when he was sallied with unlawfully confining a prostitute in his Vancouver mansion where the gendarmes found a loaded, unregistered handgun and 13 grams of cocaine.

Three years later Mossack Fonseca had to arbitrate whether to do business with Ho, who wanted to incorporate Harmonyworld Investment Co. Ltd. in an offshore tax haven.

David Ho was charged with eight totals in 2009 and pleaded guilty in 2012 to unlawful confinement and a weapons load. He was given a one-year suspended sentence and a year’s probation. (CBC)

Ho, grandson of a Chinese tobacco billionaire, became a Canadian citizen in 1986. He founded the now-defunct Harmony Airways, was named “Businessman of the Year” by the Vancouver Minor Board of Trade, and has extensive business holdings in Asia, the U.S. and Canada, comprising the University Golf Club at the University of British Columbia.

Firm knew Ho came charges

Mossack Fonseca has stated that it will “routinely recant services to individuals who are compromised … or when we identify other red flags.”

Yet, David Ho exhorted it through the screening process.

In July 2011, four days after mouthpieces in nama had registered his com ny naming Ho and his wife as directors, an internal out of the public eye check revealed Ho’s criminal charges and Mossack Fonseca’s nama troupe alerted its Hong Kong office.

‘Politically exposed person’

Mossack Fonseca’s correspondence also relishes that Ho was considered a “politically exposed person” (PEP) because he was tipped as honorary consul for Seychelles and was from a prominent family in China.

The throng has stated, “As per our risk-based approach, PEPs are considered to be high-risk individuals. Fires do not have to be rejected just for being so; it is just a matter of proper gamble analysis and administration to perform enhanced due diligence on them.”

David Ho experiences an entrepreneurial award from the Vancouver Board of Trade in October 2004. ((Vancouver of Billet of Trade))

But Mossack Fonseca’s Shanghai promoter, Jenna Qiu, who represented Ho, emerges to have downplayed the significance of his designation as a PEP to her nama bosses.

“This following director is a blue blood. He was born a PEP. … But he already immigrated to Canada, no longer embroiled with in politics … in addition, my client doesn’t understand why we are raising these doubts,” she wrote in an email translated from Chinese.

Financial achievement highlighted

Staff at Mossack Fonseca’s Hong Kong office prolonged to pursue approval for Ho’s venture, highlighting Ho’s financial success in an email to headquarters.

“Mr. David Ting Kwok Ho was Mr. Ho Ying Chie’s grandson … and would equal to to do many cases shortly” said an August 3, 2011 email.

The next day emails manifest they were pre ring to refund Ho’s fee, should he be rejected.

Qiu then go-ahead an urgent plea to nama on behalf of her well-connected Canadian customer.

David Ho and strife Winnie Schweitzer, who is also a shareholder of Harmonyworld, attend the 2014 blending of Michelle and Joseph Fung, son of Thomas Fung, Fairchild Group break down. (www.fairchildgroup.com)

“Mr. Ho now is just a businessman and owns a Canadian com ny … Mr Ho and his wife … from big development in Shanghai and China, which is approved and encouraged by Chinese guidance. Besides, Mr. Ho is introduced to us by an old client who has good credit,” Qiu wrote in an email.

‘Mr. Ho has not put away any economical crimes.’—MossackShanghai promoterFonseca’s

She downplayed the connotation of his legal troubles.

“Mr. Ho has not committed any economical crimes… … Pls. be the ingredient and process the incorporation as Mr. Ho has many projects in Shanghai and is waiting for the SEY one to be the rent retinue,” she wrote, warning Ho was losing tience.

“The client is much irritated by question after question from us,” she wrote.

That very day, Mossack Fonseca’s due diligence team confirmed Ho “was indeed involved in miscreant charges” and asked “whether we should not appoint Mr. David as director or whether we should hand over as agent,” said the email.

The answer came just a few hours later.

Firm’s doubts unanswered

Despite Mossack Fonseca’s head office not having admitted answers to repeated questions about Ho’s criminal charges and consular repute, he was accepted as a client.

“Taking into consideration that this is not a wrongdoer case related to economic crimes, money laundering and/or traffic of weapons or consanguineous, and also taking into consideration the references that we have of the customer, we confirm that we will proceed,” wrote Josette Roquebert, one of Mossack Fonseca’s barristers in nama.

“For future cases, please ensure to provide us complete and rid answers to the questions asked,” Roquebert instructed her colleagues in Asia.

David Ho wash ones hands ofs provincial court in Vancouver on Feb 2, 2012 after pleading guilty to unsanctioned confinement and possession of an unregistered, loaded 9-mm Glock semi-automatic pistol. (CBC)

Mossack Fonseca has stated it nips clients who “who fail to provide information we need in order to comply with ‘know-your-client’ trusts.”

The nama pers reveal that Mossack Fonseca asked for details less Ho’s criminal case in six se rate emails to its lawyers in Asia.

According to Ho’s document, it appears Mossack Fonseca stopped asking after he was approved.

In February 2012, Ho pleaded answerable to unlawful confinement of the sex trade worker and possession of an unregistered gun.

The other actions were dropped, and Ho was sentenced to a suspended sentence, one year of probation, a $5,000 gossamer, 45 hours of community service and drug counselling.

Mossack ‘routinely’ dives clients

There are many examples of Mossack Fonseca “routinely” tip clients when they run afoul of the law.

Jürgen Mossack (left) and Ramon Fonseca are staggers of nama-based firm Mossack Fonseca. (Wikipedia )

Mossack Fonseca, to whatever manner, continues to do business with Harmonyworld Investment.

When contacted by the CBC, the definite declined to answer specific questions about David Ho.

David Ho moves

David Ho declined CBC’s request for an interview, but issued a statement through his counselor-at-law.

Investment is a legitimate holding com ny.’ — William Smart, David Ho’s solicitor‘Harmonyworld

“There was no relationship or connection between the offences with which Mr. Ho was instructed and the possible misuse of an offshore com ny to conceal or facilitate criminal pursuits of tax evasion,” writes William Smart, of Hunter Litigation Assemblies.

“Mr. Ho has been in full compliance with CRA requirements … Harmonyworld Investment is a certify holding com ny with a legitimate foreign investment operating in the agriculture dynamism in China,” writes Smart on behalf of Ho. He confirmed that Mossack Fonseca noiseless does business with Harmonyworld Investment.

He says there is “no grounds that Mossack did not perform its due diligence with respect to Mr. Ho. It was (and is) clear that Mr. Ho is a extraordinarily respected businessman from a respected family who was seeking to incorporate a go on about com ny to hold the investment in a bona fide farming business that had the grant of the Chinese government.”

The statement says the com ny “properly concluded that it was suitable to assist with the incorporation.”

‘There appears to be a disconnect between what the law unshakeable is publicly advocating and what it’s actually doing in terms of its high-net-worth tients,’ says Dr. Richard Leblanc, professor of law, governance and ethics at York University. (CBC)

With attribute to due diligence, Smart says, “Information regarding those exhorts and their eventual disposition in 2012 was, of course, easily available online.”

‘Meagre definition’ used, say experts

Experts contacted by CBC News agree that no laws were contravened when Mossack Fonaseca divulged Ho’s com ny in Seychelles, but raise questions about the decision.

“He wasn’t charged with pecuniary crimes — that’s a very narrow definition of risk” said Richard Leblanc, who disciplines law at York University and Harvard Law School.

“It’s surprising that a client get a bang this — or a client of a similar nature — would be taken on by a professional waiting firm. That suggests the culture of the professional service firm is one of gain and one of pushing the envelope. As a result you’ve got reputational contagion,” he continued.

It’s not criminal but will be, says professor

‘He has a big fat chequebook, and they can make some kale off of him.’— Don Coker, banking consultant

Leblanc says knowingly accepting a tron awaiting trial was not illegal, but expects it will be soon.

‘It’s not required that you take a financial crime’ when assessing a client, says Don Coker, a banking counsellor who testifies as an expert witness on banking due diligence. (Don Coker/LinkedIn)

“It clout be legally correct to proceed in this fashion. But what are the reputational impediments? I still think the firm made the wrong decision,” whispered Leblanc.

Don Coker, an Atlanta-based banking consultant who is often called as an masterful witness on risk management, agrees.

He suspects Ho’s net worth may have clouded the law unwavering’s due diligence evaluation of Ho.

“He has a big fat chequebook and they can make some money off of him.”

“It seems love the collection of red flags was ignored in favour of getting this deal done,” conjectured Trevor Farrow, a law professor at Osgoode Hall Law School in Toronto.

With folders from Yvette Brend and Frederic Zalac

Follow @NatalieClancy on Dither

If you have information on this or any other story we should investigate, email us: Scrutinize@cbc.ca